Introduction

In the vast landscape of renewable energy initiatives, understanding the intricacies of incentive programs is crucial for individuals and businesses looking to adopt sustainable practices. One such integral component of Australia's commitment to renewable energy is the Small-scale Renewable Energy Scheme (SRES), with its financial incentives known as Small-scale Technology Certificates (STCs). Before delving into the impending changes in 2024, let's establish a foundational understanding of STCs and their role in the broader context of Australia's renewable energy landscape.

Definition of STCs

Small-scale Technology Certificates, or STCs, represent a form of currency within the framework of the SRES. These certificates act as a financial incentive, encouraging the installation of small-scale renewable energy systems. Predominantly associated with solar photovoltaic (PV) systems, STCs hold significant value in offsetting the upfront costs for adopting clean energy solutions. However, it is essential to clarify that STCs are distinct from traditional rebates, operating within a unique market-based scheme.

Overview of the Australian Government’s Small-scale Renewable Energy Scheme (SRES)

The Small-scale Renewable Energy Scheme, established by the Australian government, is a cornerstone in fostering the adoption of renewable energy technologies. Through the SRES, households and businesses are incentivized to invest in small-scale systems, such as solar PV installations. Central to this scheme is the creation and trading of STCs, which serve as a mechanism to reward and support those contributing to the nation's renewable energy goals. The understanding of how STCs function is pivotal for anyone considering the installation of solar systems.

Importance of Understanding STC Allocation and Value

To navigate the complexities of the SRES effectively, it is paramount to grasp two fundamental aspects of STCs: allocation and value. Allocation refers to the number of certificates assigned to a specific system, typically based on factors like system size and efficiency. On the other hand, value pertains to the monetary worth of each individual STC. The correlation between these two aspects becomes crucial when assessing the financial benefits associated with a solar PV system installation.

Deeming Period and the Gradual Reduction of STCs until 2030

A significant factor influencing the dynamics of STCs is the deeming period, signifying the number of years remaining until the SRES concludes in 2030. As a result, the allocation of STCs to a system undergoes a gradual reduction every January 1st. This systematic decline reflects the government's commitment to phasing out the subsidy gradually, aligning with the broader goal of encouraging solar energy adoption while maintaining fiscal responsibility. Understanding this timeline becomes pivotal for those planning to harness the benefits of the SRES.

In the subsequent sections, we will delve into the specific changes anticipated in 2024, exploring the reasons behind the reduction in STC rebate rates and strategies to navigate this evolving landscape effectively.

Reasons for STC Reduction

Australia's commitment to renewable energy has been a driving force behind the adoption of initiatives such as the Small-scale Renewable Energy Scheme (SRES). As we approach 2024, it becomes imperative to understand the reasons behind the anticipated reduction in Small-scale Technology Certificates (STCs) rebate rates. Examining the factors at play provides insight into the government's strategic approach and the changing landscape of solar energy incentives.

The Role of the Federal Government's Commitment

At the core of the reduction in STC rebate rates lies the steadfast commitment of the Federal Government to fostering a sustainable and economically viable renewable energy sector. While the government remains dedicated to encouraging solar energy adoption, it also recognizes the need for a phased transition. By gradually reducing the financial incentives associated with STCs, policymakers aim to strike a balance between supporting the renewable energy industry and ensuring fiscal responsibility.

Phasing Out Subsidies for Fiscal Responsibilit

The gradual reduction in STC rebate rates is part of a broader strategy to responsibly phase out subsidies. As solar energy technology advances and becomes more accessible, the financial burden on taxpayers diminishes. The government's commitment to fiscal responsibility involves recalibrating incentives to reflect the evolving economics of solar energy. This phased approach acknowledges the maturation of the solar industry and seeks to align support with the sector's increasing competitiveness.

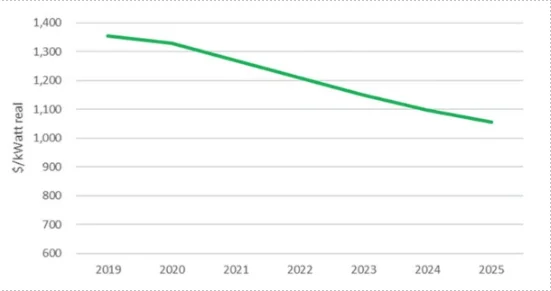

Signals of Solar Energy Becoming Competitive and Financially Sustainable

The reduction in STC rebate rates serves as a significant signal of the increasing competitiveness and financial sustainability of solar energy in Australia. As the technology becomes more widely adopted, costs associated with solar PV installations have seen a decline. The government's decision to taper down STC incentives aligns with the broader trend of renewable energy solutions becoming economically viable without the need for extensive subsidies. This shift reflects the maturation of the solar energy market, where consumers can increasingly rely on the inherent economic benefits of clean energy solutions.

In essence, the reduction in STC rebate rates is not a signal of diminished support for renewable energy but rather an acknowledgment of the sector's growing self-sufficiency. The recalibration of incentives reflects a strategic move towards a more sustainable and economically viable future for solar energy in Australia. In the subsequent sections, we will explore the forecasted trends in STC prices and provide insights into navigating this changing landscape effectively.

STC Price Forecast

As we peer into the future of Small-scale Technology Certificates (STCs) in Australia, understanding the factors influencing their prices is instrumental. A forecast of STC prices involves navigating a complex interplay of market dynamics, policy changes, and certificate availability. Let's delve into the key considerations that shape the anticipated trends in STC prices

Factors Influencing STC Prices

- Market Demand : The demand for renewable energy solutions, particularly solar PV installations, plays a pivotal role in determining STC prices. As more individuals and businesses embrace clean energy, the demand for STCs tends to fluctuate. High demand often correlates with increased STC prices, while a decrease in demand may lead to a softening of prices.

- Policy Changes : The regulatory landscape significantly influences STC prices. Any alterations in government policies related to renewable energy incentives can have an immediate impact on the value of STCs. This includes adjustments to the Small-scale Renewable Energy Scheme (SRES) or the introduction of new policies that either support or constrain the growth of the solar industry.

- Certificate Availability : The number of STCs available in the market is a direct result of the deeming period and the gradual reduction in allocations each year. As the SRES approaches its endpoint in 2030, the diminishing availability of certificates can contribute to changes in their market value. A decrease in the number of certificates can potentially lead to an increase in their individual worth.

Challenges in Predicting Exact Future STC Prices

While forecasting STC prices is essential for informed decision-making, it comes with inherent challenges. Several unpredictable variables contribute to the volatility of the market, making it challenging to pinpoint exact future prices. These challenges include:

- Global Economic Factors : Economic shifts on a global scale can influence the supply chain, manufacturing costs, and overall market conditions. Unforeseen economic events may introduce uncertainties that impact STC prices.

- Technological Advancements : Rapid advancements in solar technology can affect the cost of solar PV installations. If technological innovations lead to more cost-effective systems, it may influence the demand for STCs and, consequently, their prices.

- Policy Dynamics : The political landscape can be unpredictable, and changes in government policies, both domestically and internationally, can swiftly alter the trajectory of STC prices. Political decisions on energy policies and climate initiatives can introduce uncertainties in the market.

STC Rebate Rates in 2024

As we approach the anticipated year of 2024, the landscape of Small-scale Technology Certificates (STCs) rebate rates is poised for change. Navigating this pivotal juncture requires a keen understanding of the factors influencing rebate rates, avenues for accurate information, and the imperative of timely action. Let's delve into the considerations surrounding STC rebate rates in 2024.

Dependency on Government Policies and Market Dynamics

- Government Policies : The rebate rates for STCs in 2024 will be intricately tied to government policies governing renewable energy incentives. Any adjustments or modifications to existing policies can directly impact the financial incentives provided through STCs. Staying informed about government decisions related to the Small-scale Renewable Energy Scheme (SRES) is crucial for understanding the trajectory of rebate rates.

Consultation with Solar Installation Providers or the Clean Energy Regulator for Accurate Information

- Solar Installation Providers : Engaging with reputable solar installation providers is a valuable step in obtaining accurate and up-to-date information on STC rebate rates. These professionals have firsthand knowledge of industry trends, policy changes, and market dynamics. Consultation with a trusted installer can provide personalized insights based on the specifics of your solar installation.

- Clean Energy Regulator : For authoritative information, the Clean Energy Regulator is the official body overseeing the implementation of the SRES. Regularly checking updates from the Clean Energy Regulator ensures access to the latest policies, guidelines, and announcements related to STCs. This direct source of information enhances transparency and accuracy in understanding rebate rates.

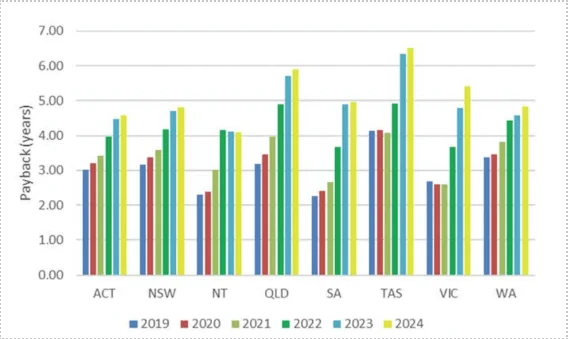

The Importance of Acting Promptly to Secure Higher Rebate Rates

- Timely Decision-Making : In the realm of STC rebate rates, acting promptly is paramount. The dynamics of government policies and market conditions mean that rebate rates can change. By making informed decisions and initiating the solar installation process promptly, there's a higher likelihood of securing favourable rebate rates before any potential adjustments.

- Anticipation of Changes : Given the forecasted reduction in STC rebate rates, there's an added urgency to act before the expected decrease in 2024. Anticipating changes and taking proactive steps align with the goal of maximizing financial incentives. This strategic approach positions individuals and businesses to benefit from higher rebate rates before they undergo adjustments.

Strategies to Maximize Benefits

As the landscape of Small-scale Technology Certificates (STCs) undergoes changes, individuals and businesses seeking to maximize the benefits of solar energy adoption can employ strategic approaches. These strategies go beyond simply understanding the STC rebate rates and encompass broader considerations for enhanced sustainability and financial viability.

Combining Solar Systems with Energy Storage Solutions

- Maximizing Energy Usage : Integrating solar systems with energy storage solutions, such as batteries, allows for the efficient storage of excess energy generated during peak sunlight hours. This stored energy can then be utilized during periods of low sunlight or high electricity demand, optimizing the overall use of solar power.

- Reducing Grid Dependence : Energy storage solutions contribute to a greater degree of self-sufficiency by reducing dependence on the grid. This not only enhances reliability but also positions individuals and businesses to benefit from stored energy during times of peak demand, potentially mitigating the impact of reduced STC rebate rates.

Monitoring Other Government Incentives to Offset STC Reduction

- Exploring Alternative Support Mechanisms : As STC rebate rates are anticipated to decrease, keeping a vigilant eye on other government incentives or programs becomes crucial. Governments may introduce alternative mechanisms to support and incentivize solar energy adoption. Staying informed about these initiatives ensures the ability to offset the impact of STC reductions with additional support.

Implementing Energy Efficiency Measures

- Reducing Energy Consumption : Implementing energy efficiency measures within homes or businesses is a proactive way to enhance the overall value derived from solar systems. By reducing energy consumption, individuals can maximize the impact of their solar installations, even with lower STC rebate rates.

Taking Advantage of Net Metering to Sell Excess Electricity

- Offsetting Electricity Bills : Net metering allows individuals to sell excess electricity generated by their solar panel systems back to the grid at a retail rate. This provides a practical means of offsetting electricity bills, potentially compensating for the reduction in STC rebate rates.

Optimal Timing for Solar Panel Installation During the Off-Season

- Capitalizing on Lower Prices : Solar panel installers typically offer lower prices during the off-season, which usually spans from November to February. By strategically timing the installation of solar panels during this period, individuals and businesses can capitalize on cost savings and potentially offset the impact of reduced STC rebates.

Consideration of Financing Options to Make Installation More Affordable

- Exploring Financing Solutions : The upfront cost of installing solar panels can be a deterrent for some. Exploring financing options, such as loans or leasing programs, can make solar panel installation more affordable. This approach enables individuals to initiate solar projects without a significant initial financial outlay.

Conclusion

In the face of impending changes to Small-scale Technology Certificates (STCs) and the evolving Australian solar energy landscape, proactive planning and timely action are paramount. The strategies discussed, from integrating energy storage to exploring alternative incentives, underscore a dynamic approach to navigate shifting dynamics. As the solar industry matures, marked by reduced STC rebate rates, Australia's commitment to sustainability remains steadfast. Ensuring a sustainable and financially viable future requires strategic decision-making, continued support for renewable energy, and a collective effort to shape an enduring energy landscape. By embracing change and staying informed, individuals and businesses can contribute to a resilient future powered by clean, sustainable, and economically viable energy solutions.