Qualifying small renewable energy systems are fully entitled to various small technology certificates, or STCs, under the Small-scale Renewable Energy Initiative. It's a crucial part of Australia's solar rebate program.

This was established to encourage the implementation of renewable and sustainable energy sources while simultaneously significantly lowering emissions of greenhouse gases.

Hence, with the purpose of discussing this important topic, in this particular article, we will talk about Solar STC in detail.

What is the scope of STCs on home solar systems?

Home solar systems are the most affordable in Australia. But they are available at lower prices if you consider STC incentives or small technology certificates (STCs).

By 2021, acquired STCs will make solar panels 30 to 40% cheaper than the previous making charge. However, the incidence slightly lowers each year, and there is a 10% decrease between 2021 and 2022.

Why should people choose solar systems in Australia?

Australia being a country where the sun is sweltering 5 to 6 hours a day, is known to deliver renewable energy at the fastest rate in the world. The world has always been very receptive to changing times and, with this understanding, brought different systems to manage times more efficiently.

What is the solar STC?

Technical certificates for small businesses for solar and small enterprises under 100kW of the solar system in Australia. They are based on the amount of electricity the solar-powered system will produce until 2030.

One MWh of electricity is convertible into one STC. Example: If your system can generate 100MWh of electricity by 2030, then based on the trading price of different STCs, and it could go up to $ 40.

Some areas in Australia also offer discounts in a Supply Chain, where one can sell additional energy to the government. Feed-in Tariffs are usually 7 to 12 cents per kWh, depending on your electricity supplier.

What is the deeming period?

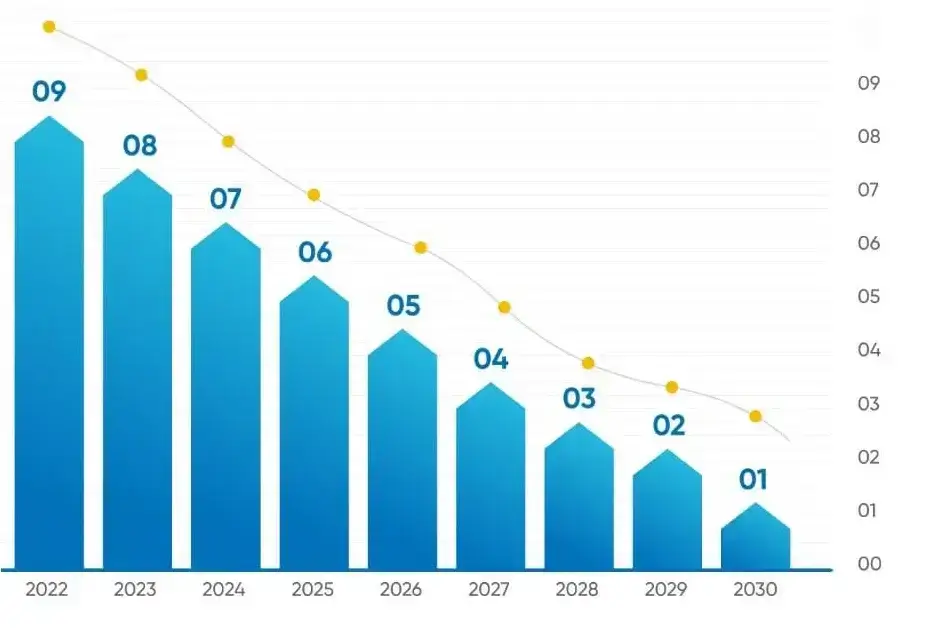

The deeming period refers to an estimated time when the system will provide renewable energy. Its deadline coincides with the STCs that will create energy till the year 2030. For example, if you install the system by 2022, your deeming time is 9 years.

How do you calculate STC solar discount for solar panels?

- The STC incentive rewards you with a measure of the output of solar panels during reflection.

- This period starts with the year you install the solar panels, and the calculation considers the whole year, regardless of the exact installation date. The decision period expires on December 31, 2030.

- You get one STC for every kilowatt, approximately 1,000 hours of limited output during the duration.

What are some factors that affect the calculation of STC?

Three factors are considered in the STC calculation, apart from the time frame. They are:

- The size of the solar PV system: Larger units or extensive systems generate more electricity over time and receive more STCs. One should strictly remember that there is a limit of 100 kW in this booster, and you should apply for another system if your system is extensive.

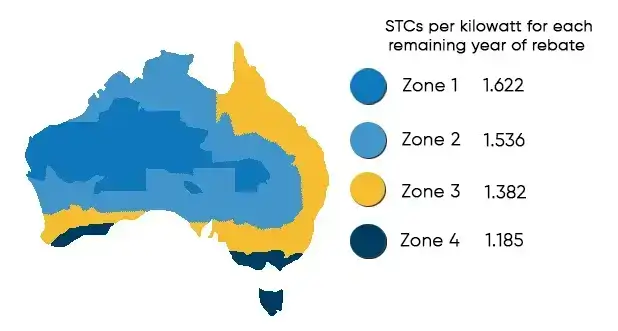

- Postal code to install the system: Solar panels are most productive in tropical areas. If you apply similar strategies and install identical machinery in different postal codes, those with more sunlight also get more STCs.

- Location: The government determines the discount date used by STCs depending on the system's location. Location plays an essential role in the production of electricity using solar systems.

The amount of sunlight that falls on a solar panel varies according to the site of the solar system. Also, if the area is prone to dust, it may harm the generation. Australia, therefore, is divided into four areas as postal codes.

STC incentives will remain available until 2030 but become smaller with each passing year. By installing your solar panels ahead of time, you can shorten their payment period and increase your return on investment.

The formula for calculation of STC along with examples

A formula is used for the analysis of STC. It is stated as;

Number of STCs created = Postcode Zone Rating X Deeming Period Years X System Size in kW

For example, if you reside in Sydney and have installed a solar panel of 6.6kW in Jan 2022, then the number of STCs created will be 82.

That is because, as per the STC zone map, Sydney falls in Zone 2; therefore, its Postcode Zone Rating is 1.382.

As per the formula, 6.6×1.382×9 = 82 STCs.

Now, if the price is approximately $28, then 82×$28 = $2296.

Is my home solar system compatible with STCs?

The Clean Energy Regulator seeks to ensure that only advanced solar systems receive their benefits, which means that there are a few conditions that must be met

- The Clean Energy Council list of approved products uses solar panels and inverters.

- CEC Authorized Designers and installers must configure the solar power system.

- The system must meet Australian and New Zealand standards and any applicable local requirements.

Conclusion

If you are still thinking about whether or not now is the opportune time to engage in solar panels, don't be. Start making the most of the STCs and bring the solar change home with you. Please do not hesitate to consult us if you have any further questions.